Read the Executive Summary

The Executive Summary, including key findings from the report and recommendations for industry, is available to read online. Continue >>Read the Full 2017 Report

Read on, or download the full report here. Download theFull 2017 Report

Review the Company Data

Look through the data to see how each company stacks up for individual indicators. Continue >>EXECUTIVE SUMMARY

Disclosing the Facts 2017: Transparency and Risk in Methane Emissions is an investor report designed to promote improved methane management and reporting practices among oil and gas producers. This report is both broader and more limited than prior Disclosing the Facts reports. Prior DTF reports have focused on best practices across a range of risk areas (chemicals, air, water, community impacts) by oil and gas companies engaged in horizontal drilling and hydraulic fracturing in the United States and Canada. While Disclosing the Facts 2017 focuses on a single issue -- methane emissions management -- the report does not limit its focus to fracturing operations in unconventional resources. Since methane emissions can occur across unconventional and conventional upstream exploration and development, this full range of operations is included.

Download the Executive SummaryWe note the entire natural gas value chain merits attention, from upstream production operations through distribution to end-users (power plants, manufacturing operations, and business and residential consumers). The U.S. Environmental Protection Agency estimates that natural gas and petroleum systems are the largest contributors to U.S. methane emissions, with upstream gas and oil production contributing 72 percent of the system’s methane emissions.

Download the full press release

Investors are focused on methane because it is the primary component of natural gas and has an intense, short-term climate forcing impact. Over a twenty-year period, methane’s “global warming potential” is at least 84 times that of carbon dioxide. Natural gas is often promoted as a bridge fuel to help move the global economy away from high carbon energy sources such as coal. Accordingly, oil and gas companies are increasing the percentage of gas in their energy resource base, with the intent of decreasing the greenhouse gas intensity of their product mix. But while natural gas burns more cleanly than coal, to the extent methane emissions from across the natural gas and oil value chain are not controlled, the potential benefit from burning gas over coal will be lowered.

Investors’ attention to methane reflects their increasing focus on reducing “carbon risk” in their portfolios. Portfolios commonly hold a wide spectrum of economic sectors, so issues from rising sea levels, to increased storms, physical damage to buildings and infrastructure, changes in water availability, and reduced agricultural productivity, among others, caused by a warming globe will have negative long-term portfolio implications. In fact, these harms are already being felt across the U.S. as 2017 brought some of the most intense hurricanes on record, floods, drought, and raging wild fires across western states. Global regulatory responses to climate change are also increasing business risk to carbon-intensive companies such as oil and gas producers. Governments around the globe have agreed to take measures to keep warming well below 2 degrees Celsius, highlighting the global intention to transition away from carbon-intensive fuels.

Reducing methane emissions can also be cost-effective for companies. Efficiencies can be improved as new methane-reducing equipment is put on-line and methane emissions can be captured and placed in pipelines for sale or used to power operations. The rate of return on investment depends on amounts of gas captured, efficiencies achieved, the expense of monitoring and capture, and the market price of natural gas.

Following the maxim of “what gets measured gets managed,” and to address rising investor concern, Disclosing the Facts 2017 ranks companies on disclosures of key elements of their methane emission management and reduction processes. Disclosing the Facts 2017 seeks disclosure not only of quantitative information about the impacts of company operations to eliminate methane emissions but also qualitative information about corporate policies and practices. Sound corporate management of upstream methane emissions requires thorough, systematic planning, from site development through capturing gas and oil in pipelines. New wells need to be sited near existing gas transport infrastructure or not placed in operation until such infrastructure is created. Companies should deploy advanced equipment designs that eliminate or minimize emissions. Focused emissions monitoring and measuring programs will not only end existing leaks, but help establish maintenance priorities for preventing emissions.

Methane emissions management programs should encompass the thousands of existing facilities whose construction predates U.S. EPA regulations that impose tighter standards on new and modified facilities. Because of their age and use of older technologies, existing facilities may be especially sizeable emitters. The best company programs establish targets for reducing overall emissions intensity (the percentage of methane emissions compared to production), provide economic incentives to senior and field staff for reductions, and report progress over time. Since the U.S. EPA emissions inventory is based primarily on increasingly outdated engineering calculations and measurements, improved emission measurements are essential. The best company programs will generate measurement data to focus company reduction initiatives and help improve the EPA inventory data.

Disclosing the Facts 2017 comes at a time of increased industry attention to methane emissions and regulatory change. This increased focus on methane is highlighted in a number of recent announcements of voluntary emissions reductions, reporting measures, and reduction targets. The American Petroleum Institute announced the formation of an environmental partnership of 26 companies, including many of the top U.S. natural gas producers, to cut methane leaks from wells and other U.S. onshore production sources. Reporting under this system will be a compilation of members’ actions, with no clear commitment to company-specific disclosure. In November, large international oil and gas companies including ExxonMobil, signed on to “guiding principles” for cutting methane emissions. These announcements are in addition to voluntary commitments and reduction targets announced in 2014 and 2016 by members of the ONE Future Coalition.

It is noteworthy that these industry announcements come in the face of persistent federal efforts to roll back existing methane regulations in the U.S. As this plays out, investors will continue to advocate for sustained action and objective, quantitative disclosures by industry, regardless of regulatory status. A clear goal of this report is to establish a set of well-defined, minimum guidelines for methane management and disclosure by oil and gas companies.

Disclosing the Facts 2017 poses 13 questions reflecting a thorough, systematic approach to methane emissions management. The actions of 28 companies are assessed against these criteria, which range from engineering and maintenance practices, to thoroughness of Leak Detection and Repair (LDAR) programs, leak repair times, beyond-compliance venting and flaring reduction programs, replacement of high-bleed pneumatic controllers at existing facilities, and progress in and incentives for achieving methane intensity targets. To speed adoption within the industry of enhanced emission detection and reduction, Disclosing the Facts 2017 highlights nearly 50 notable practices by individual companies whose adoption other companies should consider.

Key Findings

- Apache, BHP, and Southwestern Energy were the three top-scoring companies, earning 12 of 13 possible points. ConocoPhillips, Hess, and Shell were close behind at 11 points each, followed by Chesapeake Energy, Newfield Exploration, and Range Resources at 10 each, and Exxon Mobil, Noble Energy, and Pioneer Natural Resources at 9 each.

- Conversely, eight companies scored just 0-3 points. Encana and Cabot Oil & Gas received no credit; Continental, EQT Resources, QEP Resources, and Whiting Petroleum earned 1 point each; Chevron earned 2; and BP earned 3 points. We believe such low results should lead to a strong investor call to action for these companies. As demonstrated by the large number of leading scorers, and the broader industry movement toward action that we are seeing, methane reduction is both feasible and strikingly important in decarbonizing energy markets. If natural gas is not significantly less carbon intensive than coal because of methane emissions, a major selling point has been lost.

- We note that the leaders in scoring this year include companies that have had a long-term commitment to sustainability reporting, companies that more recently have come to understand the value of such reporting, and companies spurred to improve disclosures through an ongoing dialogue and/or shareholder proposal process with investors.

- Companies earned credit most frequently for reporting the type of leak detection methods in use by the company, such as on-site observations by field staff or use of infrared camera technology. Companies were less likely to specify how often and where within facilities they used such methods, especially with regard to use of monitoring equipment.

- The lowest scoring or least answered question addressed whether companies had adopted a quantitative methane emissions reduction target. Only four companies in DTF 2017 have established methane reduction targets. All of these companies are participating in the ONE Future Coalition. (Apache, BHP, Hess, and Southwestern Energy).

- A second low-scoring question asked if companies incentivize greenhouse gas reductions at the Board, management, or staff levels. Investors have increasingly demonstrated their concern about carbon risk, both to the companies they hold in their portfolios and from the broader portfolio perspective. Incentivizing greenhouse gas reduction action is a clear means of moving companies to focus on carbon reduction, thereby reducing carbon risk.

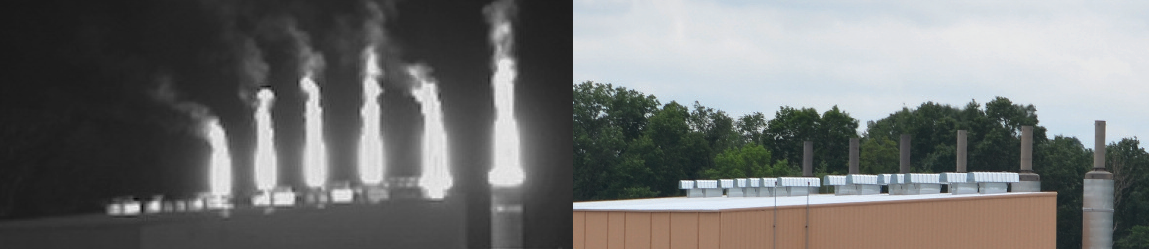

- The report emphasizes that strengthened leak detection and repair programs are essential to improving methane management. A number of recent studies have uncovered the phenomenon of “super-emitters” -- large leaks from random equipment failures. Researchers have not found predictable patterns of super-emitters towards which preventive actions should be targeted, making leak detection important to finding and repairing these large sources of leaking methane.

- Companies with LDAR programs that address a broad range of potential sources and that monitor more, rather than less, frequently (for example quarterly rather than annually) are more likely to detect super-emitters than those companies that do not, enhancing their chances of capturing emissions that would be lost to the atmosphere.

- Through increased leak detection required by regulations or done voluntarily, some companies are generating expanded internal emission inventories. These include more emission points than regulations require to be reported and they generate data to better focus companies’ equipment redesign and preventive maintenance actions.

- Most data compiled on methane emissions are based on engineering estimates and assumptions; actual emission measurements are relatively rare. Research collaborations of The Environmental Defense Fund, companies, and universities have begun generating useful data that underscore the shortfalls of current EPA emission factors, the most commonly used estimates.

- Nearly 60 percent of the companies analyzed have no high-bleed pneumatic controllers or they have established goals for eliminating their remaining ones. Pneumatic controllers are estimated to produce 30 percent of the methane emissions from oil and gas production. Companies are substituting low-bleed controllers that release less methane and controllers using compressed air rather than methane, some of which are powered by solar energy.

- Companies relying on technical innovations to lower emissions report using improved thief hatch designs, automated systems that eliminate the need to open thief hatches on storage tanks, and equipment designs to lower emission risks from facilities subject to especially corrosive oil and gas production.

- Currently available leak detection technologies can cost tens of thousands of dollars each. But industry’s increased focus on methane emission management is driving improved technologies and reduced costs. We believe that technological innovation will continue unabated with resulting lower detection and measurement costs, increased accuracy of monitoring equipment, and an increased variety of ways in which data can be captured – including for instance use of drones and airplane-based equipment. Some companies have joined with partners to spur development of such technologies, with many new technologies in the early stages of pilot testing. These include continuous emission monitors that would constantly track emissions.

2017 DATA TABLES

These tables contain the score breakdown for each company by indicator. A checkmark means the company earned a point for that metric.

| COMPANY | LDAR program description | LDAR methodologies | LDAR frequency and assets covered | Leak Repair Procedures | Engineering and Mainenance Practices | Leak Detection Training | Methane Emissions Reduction Target | Venting Practices | Flaring Practices | Methane Intensity Rate | Actual or Estimated Emissions Reporting | High Bleed Controller Replacement | Greenhouse Gas Reduction Incentives | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Anadarko | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 5 |

| Antero | 1 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 |

| Apache | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 12 |

| BHP | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 12 |

| BP | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 3 |

| Cabot | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Carrizo | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 7 |

| Chesapeake | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 10 |

| Chevron | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 |

| Conoco | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 11 |

| Consol | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 7 |

| Continental | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 |

| Devon | 1 | 1 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 7 |

| Encana | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| EOG | 1 | 1 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 6 |

| EQT | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 |

| Exxon | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 9 |

| Hess | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 11 |

| Newfield | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 10 |

| Noble | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 9 |

| Occidental | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 4 |

| Pioneer | 1 | 1 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 9 |

| QEP | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Range | 1 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 10 |

| Shell | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 11 |

| Southwestern | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 12 |

| Whiting | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| WPX | 1 | 1 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 5 |

QUESTIONS

- Does the company describe its leak detection and repair program, including the facilities and assets covered by the program?*

- Does the company describe the specific methodologies used (e.g., infrared camera, audio visual olfactory, continuous monitoring, stationary methane detectors) to identify methane leaks in its operations?*

- For each of the specific methods described, does the company describe how frequently it uses each and what proportion/percentage of each facility and/or asset is covered?*

- Does the company describe its leak repair procedure(s), principally the routine time period between leak detection and repair?

- Does the company describe its engineering and maintenance practices to prevent or minimize leaks?

- Does the company describe the leak detection training it provides its operational/production staff, contractors who routinely visit well sites and/or are hired to conduct leak detection and repair, and staff trained specifically to conduct LDAR?

- Does the company disclose an active, quantitative methane emissions reduction target, with timeline, and progress toward achieving this target?*

- Does the company describe its company-wide methane venting practices?

- Does the company describe its company-wide methane flaring practices, including success in reducing flaring?

- Does the company report the percentage emissions rate for methane measured as methane emissions per methane production on an annual basis, and/or the percentage emissions rate for methane emissions per MBoe (i.e., per thousands of barrels of crude oil equivalent, oil and gas) on an annual basis?*

- With respect to measuring methane emissions, does the company describe how it measures and reports emissions, including when it uses and reports actual measurements and when it estimates emissions using engineering calculations or emission factors?

- Does the company report the percentage or number of high-bleed controllers replaced with low-emission alternatives, or a program for their replacement?*

- Does the company disclose how it incentivizes greenhouse gas reductions at the board, management, and/or staff level through compensation structures?

The information in this report has been prepared from sources and data the authors believe to be reliable, but we assume no liability for and make no guarantee as to its adequacy, accuracy, timeliness, or completeness. Boston Common Asset Management, LLC may have invested in and may in the future invest in some of the companies mentioned in this report. The information in this report is not designed to be investment advice regarding any security, company, or industry and should not be relied upon to make investment decisions. We cannot and do not comment on the suitability or profitability of any particular investment. All investments involve risk, including the risk of losing principal. No information herein is intended as an offer or solicitation of an offer to sell or buy, or as a sponsorship of any company, security, or fund. Opinions expressed and facts stated herein are subject to change without notice. The views expressed in Disclosing the Facts 2017 do not necessarily express the views of all IEHN members.